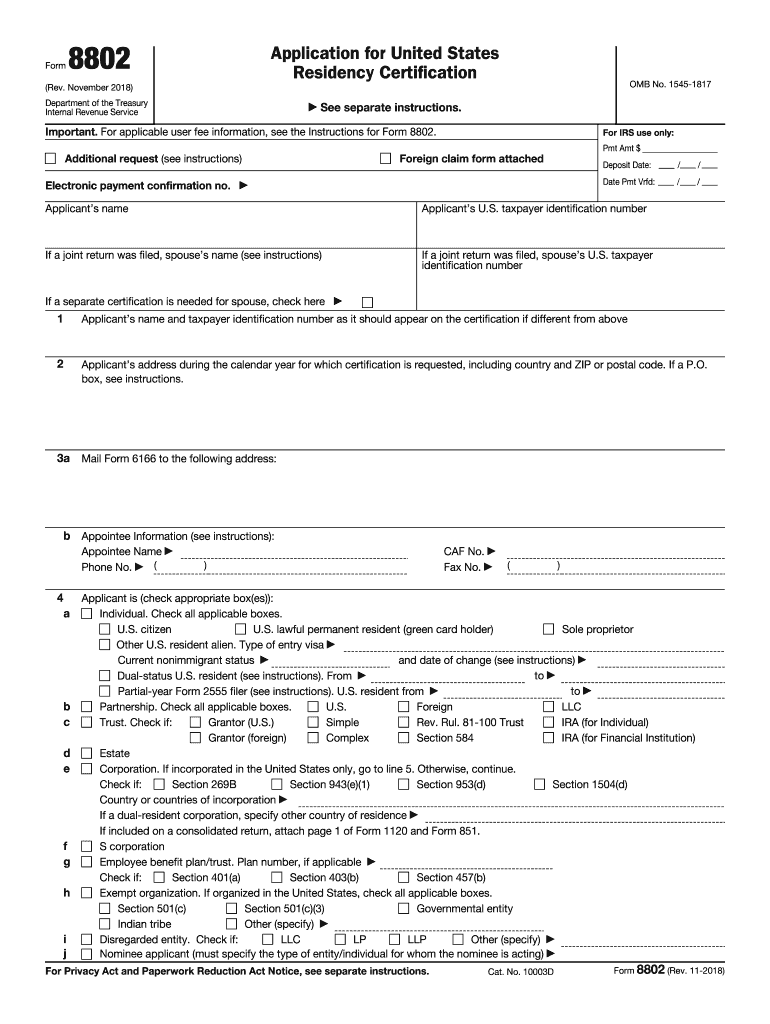

Who needs a Form 8802?

The 8802 application form is required in order to obtain a Form 6166 or certification of US Tax Residency. It is usually used to claim tax benefits. The IRS must certify that the person claiming benefits is a resident of the US.

What is Form 8802 for?

Form 8802, application for United States Residency Certification, is the first step to obtaining a certification of US Tax Residency. The latter allows you to obtain tax benefits.

Is Form 8802 accompanied by other forms?

You should attach all the required documents to the Electronic Payment IRS Form 8802, especially if you are not a US resident. The applicant must send a check or money order to cover the fee along with the form itself.

When is IRS Form 8802 due?

You should send your application with a check or money order 45 days before the date you need Form 6166.

How do I fill out IRS 8802 Form online?

The applicant should provide the following information:

-

Applicant’s name

-

Applicant’s TIN or EIN

-

Applicant’s address during the calendar year

-

Address where the Form 6166 should be sent

-

Appointee information

-

Applicant’s status (individual, partnership, trust, estate, corporation, S corporation, employee benefit plan/trust, exempt organization, disregarded entity, nominee applicant

-

Information about previous tax forms

-

Calendar year for which the certification is requested

-

Tax period on which certification will be based

-

Purpose of certification (income tax, VAT, other)

-

Information about penalties

-

Signature and date of filing (along with spouse’s signature if necessary)

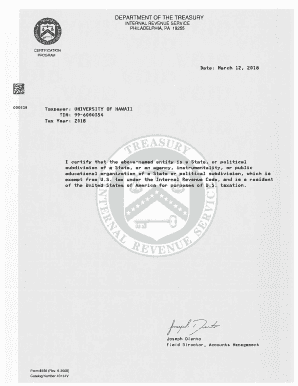

Where do I send 8802 Form?

Form 8802, along with a check or money order should be sent to IRS, Philadelphia, PA 19176-6052. If the applicant pays the fee by e-payment, the form should be sent to Department of the Treasury, Philadelphia, PA 19176-6052.